Hassle-free way to obtain a liquor license in Malaysia

- Business Registration: The business must be registered with the Companies Commission of Malaysia (SSM) or the relevant local authority.

- Premises: The business must have a suitable and approved premise for selling alcohol, such as a bar, club, pub, or restaurant.

- Ownership: The business owner must provide proof of ownership of the premises, such as a tenancy agreement or land title.

- Zoning: The premises must be located in a zone that is approved for selling alcohol.

- Health and Safety: The premises must comply with health and safety regulations, such as having adequate fire exits and fire extinguishers.

- Financial requirements: The business must have the financial capacity to support the operation of selling alcohol, such as having adequate working capital and liquidity.

- Eligibility: The business owner must be a Malaysian citizen or permanent resident who is at least 21 years old and has no criminal record.

2 Type of Liquor License in Malaysia

1

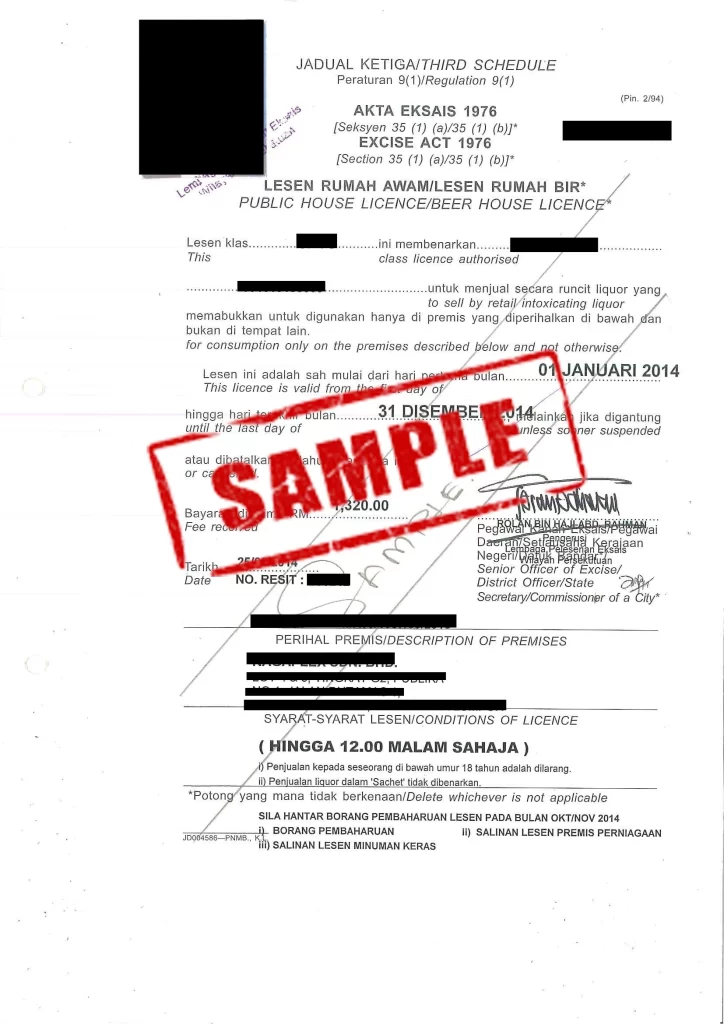

Public House Liquor License

A Public House License is a type of license that allows businesses to sell alcoholic beverages for consumption on their premises. This license is required for businesses such as bars, clubs, and pubs that serve alcoholic beverages to customers.

2

Beer House Liquor License

A Beer House License is a specific type of Public House License that allows businesses to sell beer for consumption on their premises. This license is required for businesses that serve beer to customers, such as beer bars, beer gardens, and microbreweries.

Reach the liquor license top officer!

Procedures to apply for a Malaysia Liquor License

The processing roadmap for obtaining a liquor license may vary depending on the location and specific requirements of the business. Normally it takes 1 to 6 months to complete the whole business license application.

Step 1Check Eligibility

The first step is to check if you meet the eligibility criteria for obtaining a liquor license in Malaysia. This includes being a Malaysian citizen or permanent resident who is at least 21 years old and has no criminal record.

Step 2Determine the Type of License:

The next step is to determine the type of liquor license required for your business. There are various types of liquor licenses, including Public House License, Beer House License, and Restaurant License. You may also need to obtain other licenses, such as a signboard license or entertainment license, depending on the type of business you are operating.

Step 3Obtain Approval from Relevant Authorities:

Depending on the type of license you require, you may need to obtain approval from different authorities, such as the local council, state government, or the Ministry of Domestic Trade and Consumer Affairs. It is important to check the specific requirements for your location and industry.

Step 4Submit Application:

Once you have obtained the necessary approvals, you can submit your application for a liquor license. You will need to provide all required documentation, such as proof of ownership of the premises, business registration documents, and health and safety certificates.

Step 5Pay and Wait for Processing:

There may be fees associated with applying for a liquor license. You will need to pay these fees when submitting your application. After submitting your application, you will need to wait for the authorities to process it. This may involve a review of your application and an inspection of your premises.

Malaysia License consultancy

Consult with Us Now

Expertise

Benefit from our 20+ years of strong connections to swiftly obtain your liquor license. While it typically takes a year to acquire one, our exceptional expertise allows us to speed up the process for you. Experience the fastest way to get your license with us, thanks to our long-standing relationships in the industry.

Convenience

You can save time and effort by letting our team handle the entire application process on your behalf. This can free you up to focus on other aspects of your business, such as sales and marketing, while we take care of the paperwork and regulatory requirements.

Cost Effective

A cost-effective way to obtain a liquor license in Malaysia. We offer reasonable pricing and can help you to save money by streamlining the application process and avoiding any costly mistakes or delays.

Drop a Message

Frequently Asked Questions on Liquor License Services (FAQs)

How much is a liquor license in Malaysia?

The cost of a liquor license in Malaysia varies depending on the type of license, location, and other factors. The fees for a liquor license can range from a few hundred to a few thousand Malaysian Ringgit. It is best to check with the relevant authorities or industry associations for specific costs involved.

Do you need a license to sell alcohol in Malaysia?

Yes, businesses need a license to sell alcohol in Malaysia. This is required under the Liquor Licensing Act 1953, which regulates the sale, manufacture, and distribution of alcohol in Malaysia. Businesses must obtain a liquor license before selling any alcoholic beverages, and they must comply with all relevant laws and regulations.

Can i sell alcohol in Malaysia?

Yes, you can sell alcohol in Malaysia if you have obtained the necessary license and comply with all relevant laws and regulations. The sale of alcohol is regulated in Malaysia, and businesses must follow strict guidelines to ensure that they are in compliance with all applicable laws and regulations.

Do you need a license to sell alcohol online in Malaysia?

Yes, businesses that sell alcohol online in Malaysia are required to obtain a liquor license before selling any alcoholic beverages. This applies to businesses that sell alcohol through their own websites or through online marketplaces such as Lazada or Shopee. It is important to note that selling alcohol online may also be subject to additional regulations and guidelines, such as those related to packaging and delivery.

Malaysia Services

Other Services you may need.

Accounting.my understanding what you need. From Startup to a Multinational Corporation (MNC). Our expert panels of certified accountants ease your financial management and business growth. Pick a wide variety of accounting services. More than just bookkeeping, company secretary setup, accounting, software, audit, and taxes. Our team shares insightful analysis, strategic recommendations, and local true approaches to your unique problems.

Setup Company (Company Secretary)

From startup incorporation to regulatory compliance, our company secretary services send all aids. We take care of administrative tasks, file consistent statutory records, update, and submit required paperwork on time so you can concentrate on expanding your business. No more bugs from government officials or authorities on legal mishaps!

Bookkeeping

Bookkeeping services can help business save time and money by transferring financial data from the business to a service provider like Accounting.my to maintain accurate records of all transactions.

Accounting

Accounting services in Malaysia cover payroll, tax filing, audits services, financial reporting, consulting, bookkeeping, and financial analysis. They assist in decision-making, financial management, and compliance. Outsourcing account to professionals ensures accuracy and optimization.

Software

With Accounting.my, you can automate billing, expense recording, report generation, and up to business performance analysis. Revolutionary accounting software solutions will improve company efficiency and save time in financial management. Let us examine your necessities and propose the program that meets you best. Your team will thank you for the smart tool.

Audit

You will keep your organization flowing and solid from breaches with our Professional Audit services. Certified auditors will evaluate your financial statements without bias. Screen for conformity with industry standards and offer you useful insight on your company’s financial health in the process. With our in-depth abilities and expertise, we can help you spot risks, find wasteful practices, and improve your foundation. Time to make yourself credible in the face of stakeholders and investors.

Tax

You may stumble trying to understand the tax system. Our tax consultant are ready to support you. All aspects of taxes, from tax planning, and filing to tax returns. Our extensive knowledge of tax regulations and evolving laws changes guarantee you will fulfil your tax responsibilities while getting the least possible tax liability. Minimize your tax liability and increase your after-tax income, only with Accounting.my.