List of Top Payment Gateways in Malaysia (2025 Guide)

If you are SMEs business owner, e-commerce giant, or any individual who is new to online payment solutions, a dynamic environment requires you to have a robust and adaptable online payment infrastructure for businesses to grow.

In other words, a reliable, secure, and efficient payment gateway Malaysia to support your business transactions.

The blossom of e-commerce and retail shops is fueled by increasing internet penetration, using the right payment gateway is crucial. A seamless transaction idealizes customer experience and satisfaction can skyrocket revenues.

Our comparison of Top payment gateways in Malaysia guide list you the leading payment gateways in Malaysia, features, benefits, and factors to consider.

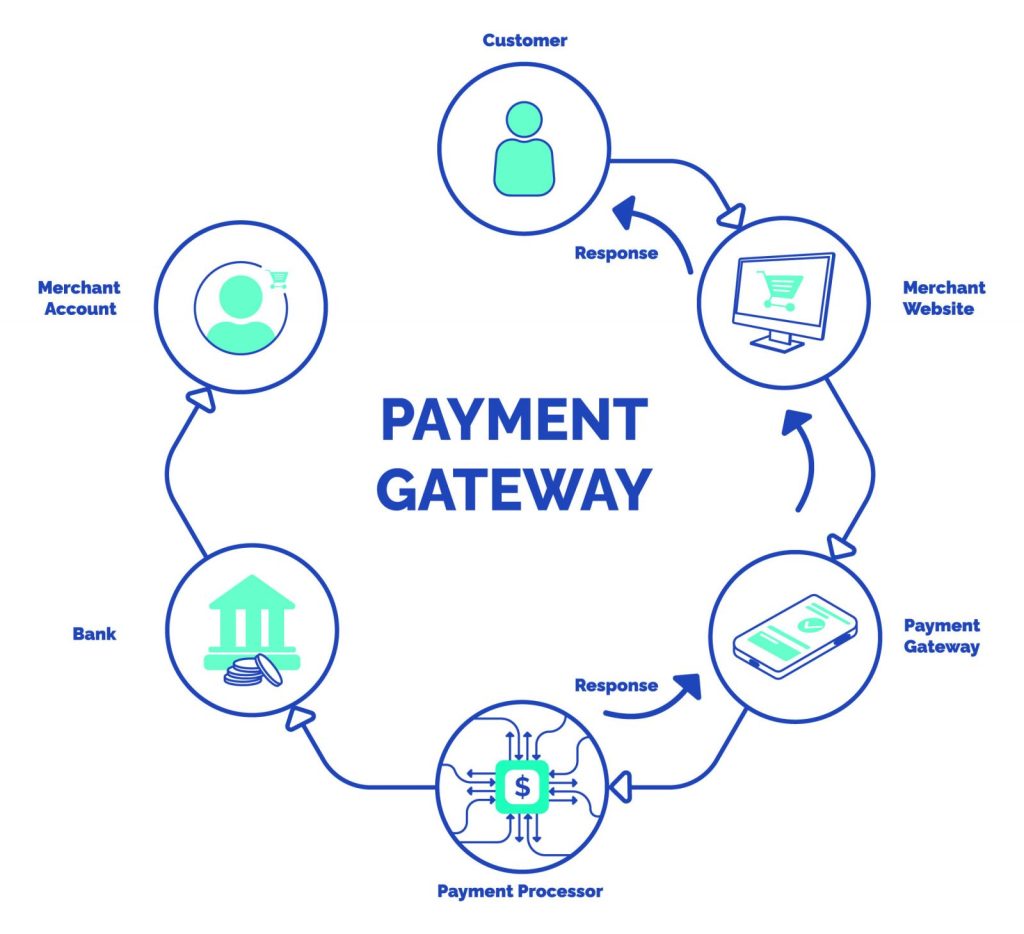

What is Payment Gateway?

A payment gateway is a method used by businesses to ideally accept payments from customers. It acts as a secure channel between a merchant’s online platform and the customer’s financial method, facilitating secure transactions and sensitive financial data. Payment gateway ensures the accurate and efficient processing of all transactions.

Payment gateway usually referred to online payment like Credit cards, debit cards, e-wallets, and many other digital payment methods, can all be hosted under one payment gateway provider in compliance with laws and regulations.

How Payment Gateway Works?

Customer Initiates Payment

Customers initiate payment process by placing an order on the merchant’s online platform and proceed to their payment details, which may include credit/debit card information, e-wallet details, or online banking credentials.

Secure Transmission via Payment Gateway

The payment gateway, as a secure channel, processes the payment details from the customer and transmits them securely to the merchant’s acquiring bank.

Merchant Bank

The merchant’s acquiring bank then forwards the transaction request to the customer’s issuing bank or the relevant payment service provider.

Authorization from Issuing Bank

The issuing bank meticulously verifies the transaction details, including the customer’s available funds and conducting necessary fraud checks – a due diligence to kill businesses’ worrisome financial ick.

Transaction Approval or Decline

Based on the verification, the issuing bank responds with an authorization to the acquiring bank, either approving or declining the transaction.

Notification to Customer and Merchant

Successful or failure to proceed, the payment gateway notifies both the customer and the merchant regarding the transaction status in completing the online payment process.

List of Payment Gateways in Malaysia

1. Paydibs

Background:

Paydibs, a rapidly growing payment gateway provider in Malaysia towards ASEAN preferred choice, focusing on delivering efficient and secure online payment solutions for all sizes of business – retail shops and online ranging from ecommerce, laundry kiosk, vending machines, and the likes. A revolutionizing Paydibs Neo is introduced in June 2025, aims to fit all sizes of businesses, with this all in one soundbox that accept from QR codes, cards, to BNPL!

Recognized by industry experts, as evidenced receipt of the esteemed Best Payment Solution Award at the 2018 Mobile Business Excellence Awards (MBEA) and Excellent Payment Solutions Provider at The 6th Lang International Corporate Titan Award 2024.

Features:

- Supports credit/debit cards, FPX, and e-wallets.

- User-friendly dashboard for merchants.

- Multi-currency support with competitive exchange rates – Indonesia, Philippines, China.

- Advanced fraud detection and security measures.

Pros:

- Competitive pricing lower than the market – highly customizable.

- Vast and great payment options coverage.

- Suitable for both SMEs owners and larger enterprises.

- Free Signup fee, only yearly fees – A great plus for local Malaysia startups.

Cons:

- Not all international countries are covered in the expansion – recommend a quick consultation.

2. iPay88

iPay88, established in 2000, is one of the leading payment gateways in Southeast Asia. Considered the most widespread payment solutions for most size of businesses.

Features:

- Supports multiple payment methods: credit/debit cards, FPX, e-wallets (Boost, GrabPay, Touch ‘n Go).

- Multiple currency payments support.

- Fraud prevention tools and payment processing security.

- Allow integration with e-commerce platforms CMS like Shopify and WordPress WooCommerce.

Pros:

- Wide range of payment method options.

- Active customer support.

- Reliable and secure in transactions with track record.

Cons:

- High setup and yearly fees compared to competitors.

- Transaction fees may be higher for smaller businesses and startup.

3. Billplz

Billplz is a Malaysian payment gateway focusing on affordable and straightforward payment solutions for SMEs.

Features:

- Flat-rate transaction fees.

- Supports online bank transfers (FPX).

- No setup or annual fees.

- Simple API for developers.

Pros:

- Cost-effective for small businesses.

- Transparent pricing structure.

Cons:

- Limited payment methods (Require activation).

- Focused primarily on Malaysian market transactions, lacks global presence.

4. eGHL

Founded in 2013, eGHL is a subsidiary of GHL Systems and caters to businesses across Malaysia and Southeast Asia.

Features:

- Supports credit/debit cards, FPX, and e-wallets.

- Multiple country currency support.

- Recurring payment options available.

- Secure transactions with PCI DSS compliance.

Pros:

- Strong focus on security.

- Broad range of payment options.

Cons:

- High setup fees for smaller businesses.

- Additional charges for advanced features.

5. PayPal

PayPal, established in 1998, is a global payment gateway renowned for its ease of use and international reach.

Features:

- Accepts payments in over 24 currencies.

- Supports credit/debit cards and PayPal wallet.

- Comprehensive fraud prevention tools.

- Instant fund transfers.

Pros:

- Ideal for international transactions.

- Easy integration with e-commerce platforms.

Cons:

- Higher transaction fees for cross-border payments.

- Limited local payment options.

6. Stripe

Stripe, launched in 2010, is a global payment processing platform designed for developers and tech-savvy businesses.

Features:

- Advanced API for custom integrations.

- Supports 135+ global currencies.

- Recurring billing and subscription support.

- Fraud detection tools.

Pros:

- Highly customizable.

- Extensive global currency support.

Cons:

- Requires technical expertise for setup.

- Slightly higher transaction fees.

7. PayHalal

Malaysia’s first Shariah-compliant payment gateway.

PayHalal is designed for businesses that require Islamic-compliant payment processing. It ensures every transaction adheres to Shariah principles, free from riba (interest), gharar (uncertainty), and haram (prohibited) elements.

Features:

Supports FPX, credit/debit cards, and e-wallets (Shariah-screened only)

Shariah-compliant transaction screening

Charity/zakat modules and halal cart options

Works with Shopify, WooCommerce, and custom platforms

Pros:

Certified halal payment gateway by IBFIM and Bank Negara–endorsed framework

Ideal for Islamic businesses, NGOs, and halal eCommerce

Strong support for ethical finance and charitable disbursements

Cons:

Not suitable for businesses offering non-halal products/services

Fewer integrations with international platforms compared to mainstream gateways

8. Curlec

Subscription billing made simple for Malaysian businesses.

Curlec specialises in recurring payment solutions, making it the go-to choice for businesses offering subscriptions, memberships, and instalment-based services. Now part of the Razorpay group, it blends local insight with regional fintech power.

Features:

Direct Debit and FPX payment automation

Subscription and recurring billing engine

Real-time payment status and dashboard

API integration for custom platforms

Pros:

Ideal for SaaS, gyms, tuition centres, and NGOs

Reduces churn with automated collections

Transparent, flat-rate pricing structure

Cons:

Less suited for one-off eCommerce purchases

May require some setup time for custom integrations

9. SenangPay

SenangPay was launched to provide simple, secure, and affordable payment solutions for SMEs in Malaysia.

Features:

- Supports credit/debit cards and FPX.

- User-friendly dashboard.

- Multi-currency support.

Pros:

- Affordable for SMEs.

- Easy setup process.

Cons:

- Limited advanced features.

- Not ideal for larger enterprises.

10. HitPay

HitPay is a modern payment gateway designed for small businesses, offering various payment options and simple integrations.

Features:

- Supports e-wallets, FPX, and credit/debit cards.

- No setup or yearly fees.

- QR payment solutions.

Pros:

- No upfront fees.

- Broad payment method coverage.

Cons:

- Transaction fees can be higher for certain methods.

- Limited to small and medium businesses.

Conclusion

Each payment gateway offers unique features and benefits. Businesses should evaluate their specific needs, transaction volumes, and target markets to select the most suitable option. Whether you’re looking for affordability (Billplz), international reach (PayPal), or advanced customization (Stripe), there’s a payment gateway tailored for your business in Malaysia.

Trends in Malaysia Payment Gateways Now

1. E-Wallet Integration

The dominance of digital wallets like GrabPay, Touch ‘n Go eWallet, and Boost necessitates their strategic integration by businesses to maintain competitiveness in the Malaysian market.

2. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services are experiencing rapid growth in Malaysia, providing consumers with flexible payment options and contributing to increased sales for businesses like Shopee – Spaylater and Grab PayLater.

3. Cross-Border Payments

International expansion by Malaysian businesses necessitates payment gateways with multi-currency support and cross-border capabilities. Countries like China & Bangladesh eCommerce stores are expanding from local Malaysia to international market.

4. Mobile-Optimized Payments

Seamless mobile experiences are crucial for payment gateways to retain customers in the era of mobile commerce. A mobile payment app is a necessity, not just limited to website browsers.

5. Retail Payment Terminal Machine Malaysia

All in all, a full retail payment solution usually has a physical store for warehousing and displaying. When it happens offline, get your best competitive MDR rate of payment terminal machine Malaysia here.

Comparison Table: Best Payment Gateways

| Payment Gateway | Setup Fee (RM) | Yearly Fee (RM) | Transaction Commission (Credit/Debit Card) | Transaction Fees (Online Banking) | Payment Methods | Supported Currencies |

|---|---|---|---|---|---|---|

| iPay88 | SME: RM2,088 | SME: RM500 | 2.9% (SME), 3.5% (Startup) | 2.8% or min RM0.60 | Visa, MasterCard, FPX, Malaysia Online Bank Transfer, PayPal, Boost, GrabPay, Touch ‘n Go, Vcash | MYR (USD and other currencies supported in multi-currency gateway) |

| Paydibs | Free | RM200/RM300 | Local Credit – 1.80%, Local Debit – 1.60%, Foreign Card – 3.20% | 1.5% or minimum RM0.80 whichever is higher. | Visa, MasterCard, FPX, Malaysia Online Bank Transfer, DuitNow Pay, Boost, GrabPay, Touch ‘n Go, Mcash, ShopeePay, Atome, Alipay, WeChat Pay, Crypto. | MYR, PHP, IDR, RMB, THB, LKR, and more ASEAN Countries. |

| Billplz | Free | Free | RM1.50 per transaction | RM1.50 per transaction | Visa, MasterCard, Malaysia Online Bank Transfer (Alliance Online, Am Online, CIMB Clicks, etc.) | MYR |

| eGHL | 399 (Starter) | 399 (Free 1st year) | 2.8% (Starter), 2.5% (Small Biz) | 2.8% or min RM0.60 | Visa, MasterCard, Malaysia Online Bank Transfer (Maybank2U, CIMB Clicks, RHB Online, etc.) | MYR |

| PayPal | Free | Free | 3.9% + RM2.00 (Domestic), 4.4% + fixed fee (Cross-border) | N/A | Visa, MasterCard, Discover, American Express, Malaysia Bank Transfer | 24 currencies, including USD, MYR, EUR, GBP, JPY, SGD |

| Stripe | Free | Free | 3% + RM1.00 | 3% + RM1.00 | Credit/Debit Cards, FPX | Over 135 currencies, including MYR |

| Razer Merchant Services | 499 (Lite) | 99 (Lite, waived 1st year) | 3.8% (Lite), 2.4% (Premium) | 3.8% or min RM0.60 (Lite), 2.4% or min RM0.60 (Premium) | Visa, MasterCard, Malaysia Online Bank Transfer, E-wallets (Boost, GrabPay, Touch ‘n Go, etc.) | MYR |

| SenangPay | No | 300 | 2.5% (Mastercard and Visa) | 1.5% or min RM1.00 | Online banking, Credit/Debit Cards | Limited international payment options |

| HitPay | No | No | 2.5% – 3.5% | 2.5% – 3.5% | GrabPay, Boost, FPX | Supports multiple currencies |

| GHL | 500 | 500 | 2.8% | 2.8% or min RM0.60 | Visa, MasterCard, Malaysia Bank Transfer, E-wallets | MYR |

Disclaimer: The data and information is based on current data as we last updated. It may be summarized and not as detailed; subject to change. For the most accurate and comprehensive features, please refer to the respective payment gateway providers’ official websites or contact their sales representatives.

Legal Disclaimer:

All brand names, trademarks, and logos displayed on this website are the intellectual property of their respective owners. Their use herein is solely for descriptive and identification purposes. This website makes no claim of ownership, endorsement, or official association with any of the mentioned brands unless expressly stated. No affiliation, sponsorship, or partnership should be implied.

Contact - Accounting Service

For any inquiries or to schedule an appointment, please reach out to us using the contact details below:

- Phone: [+6011-1671 2713]

- Email: [accmy333@gmail.com]

- Address: [27-2-1, Jalan Medan Putra 6 Medan Putra Business Centre, Bandar Sri Menjalara, 52200 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur]